Child Tax Credit 2024 Income Limit Chart – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . What to expect for 2024?. The child tax credit and other family tax credits It’s important to note that income limits apply to these benefits. The IRS has strict guidelines for which .

Child Tax Credit 2024 Income Limit Chart

Source : www.brookings.edu

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

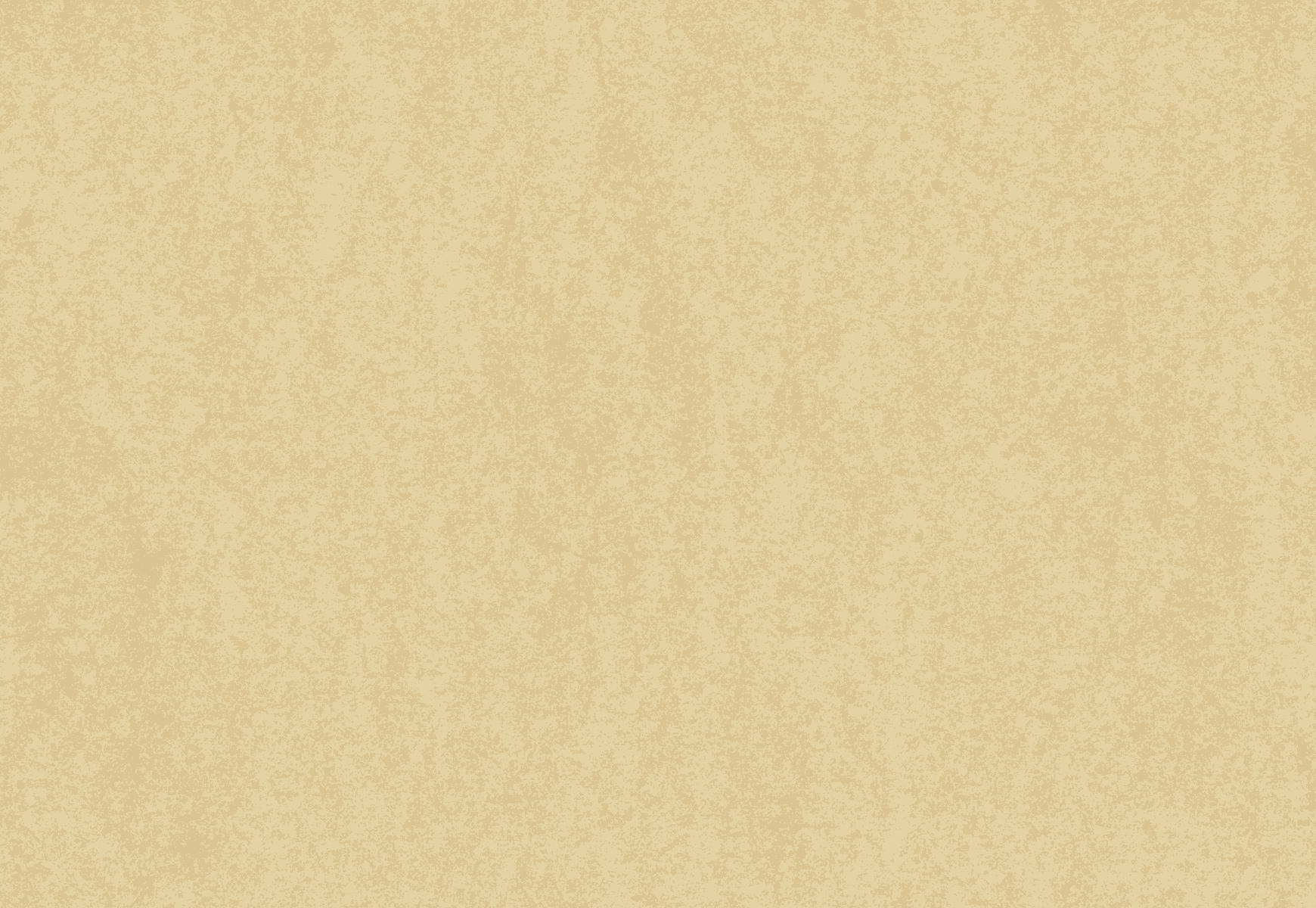

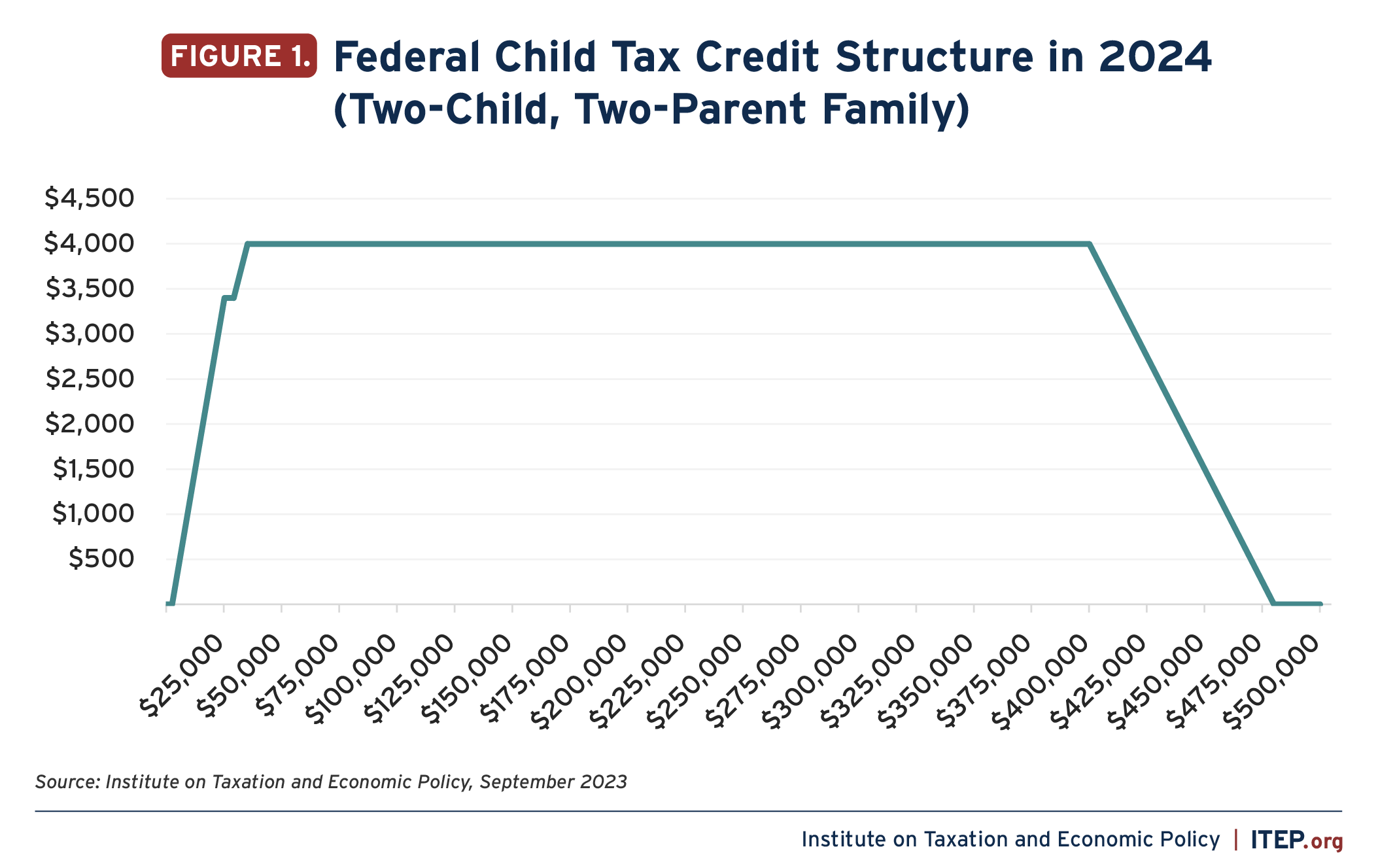

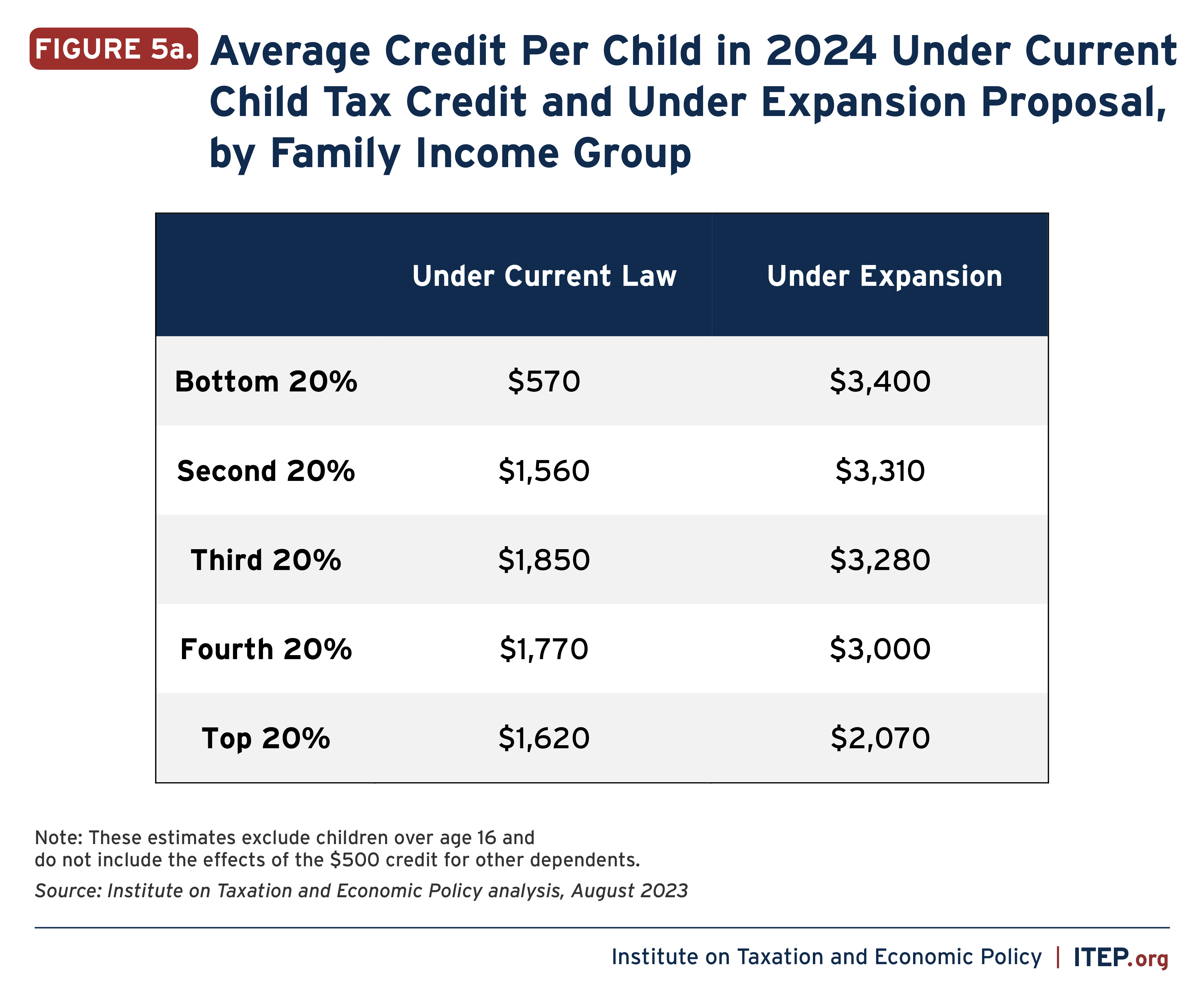

Expanding the Child Tax Credit Would Help Nearly 60 Million Kids

Source : itep.org

Yearly Income Guidelines and Thresholds Beyond the Basics

Source : www.healthreformbeyondthebasics.org

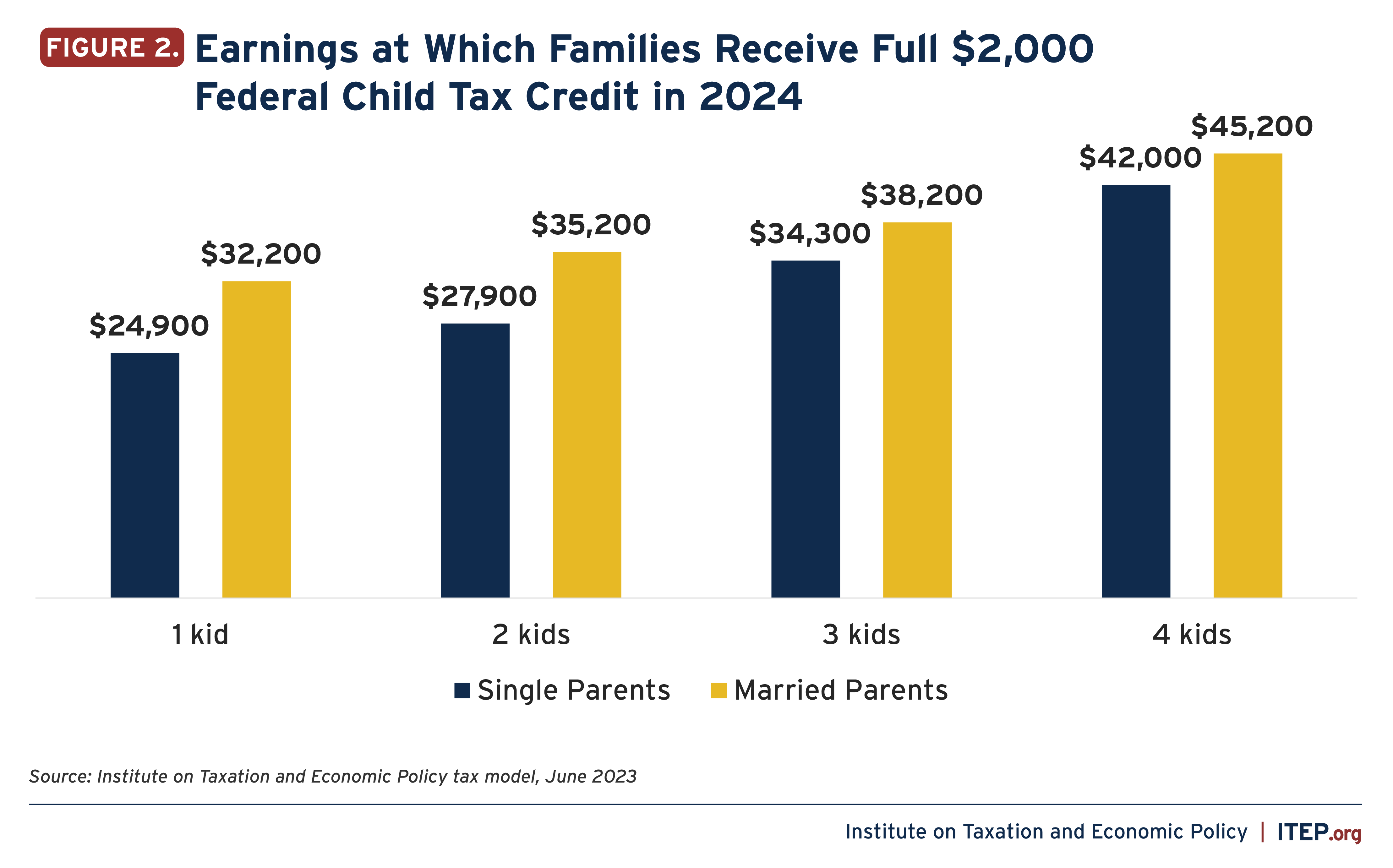

Expanding the Child Tax Credit Would Help Nearly 60 Million Kids

Source : itep.org

Tax Calculator: Return & Refund Estimator for 2023 2024 | H&R Block®

Source : www.hrblock.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Policy Basics: The Earned Income Tax Credit | Center on Budget and

Source : www.cbpp.org

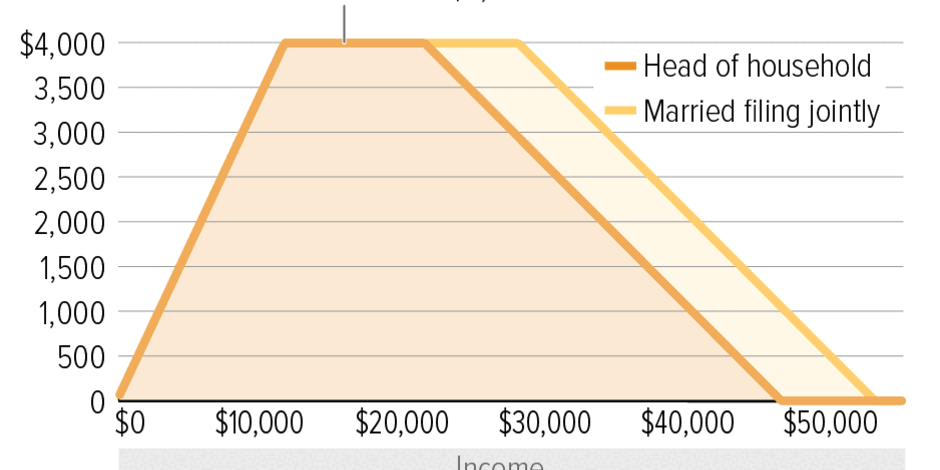

The American Families Plan: Too many tax credits for children

Source : www.brookings.edu

Expanding the Child Tax Credit Would Advance Racial Equity in the

Source : itep.org

Child Tax Credit 2024 Income Limit Chart The American Families Plan: Too many tax credits for children : Child Tax Credits 2023: What can you do if you haven’t received your refund? Personal Finance. CalFresh IRT Chart you can expect for the 2024 tax year (for income tax returns normally filed . For those that do not claim the federal Child Tax Credit, the income limits determine eligibility: For single filers, the income limit is $75,000 or less For those who are married and file jointly .