Child Tax Credit 2024 Qualifications Income – Had or adopted a child in 2023? What new parents need to know about tax credits and deductions. Importantly, the enhanced Child Tax Credit went away in 2022. . Parents will notice a number of tax breaks for families with children when they file their 2023 tax return this year: The child and dependent care credit, a higher .

Child Tax Credit 2024 Qualifications Income

Source : www.cpapracticeadvisor.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Maximum Earned Income Tax Credit for 2024 #eitc #credit #irs #2024

Source : www.tiktok.com

Earned Income Tax Credit 2024 Eligibility, Amount & How to claim

Source : www.bscnursing2022.com

Child Tax Credit 2024 Income Limits: What is the income limits for

Source : www.marca.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Child Tax Credit 2024: Will there be a Child Tax Credit in 2024

Source : www.marca.com

IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : www.kvguruji.com

Child Tax Credit 2024 Eligibility: Can you get the child tax

Source : www.marca.com

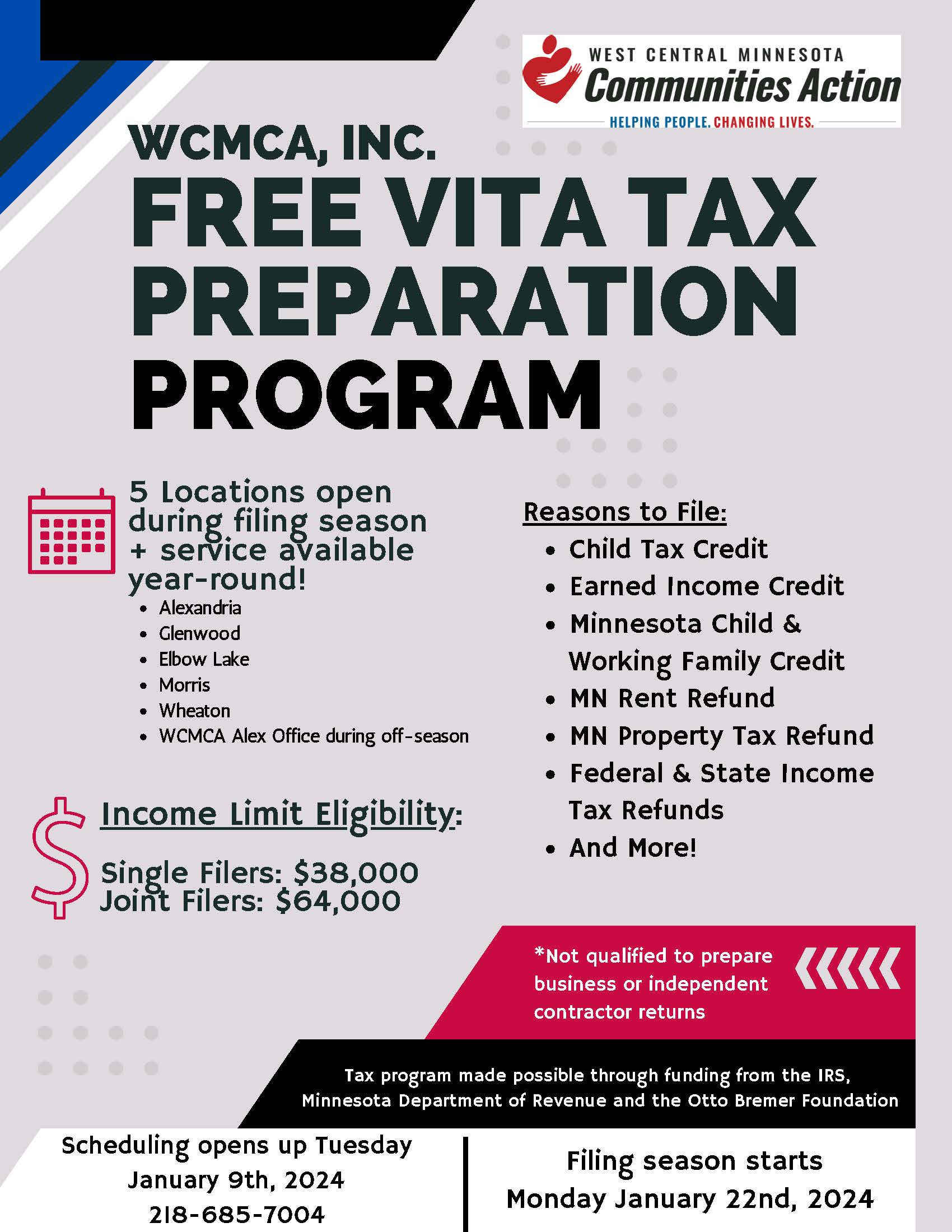

Free Tax Preparation West Central Minnesota Communities Action, Inc.

Source : wcmca.org

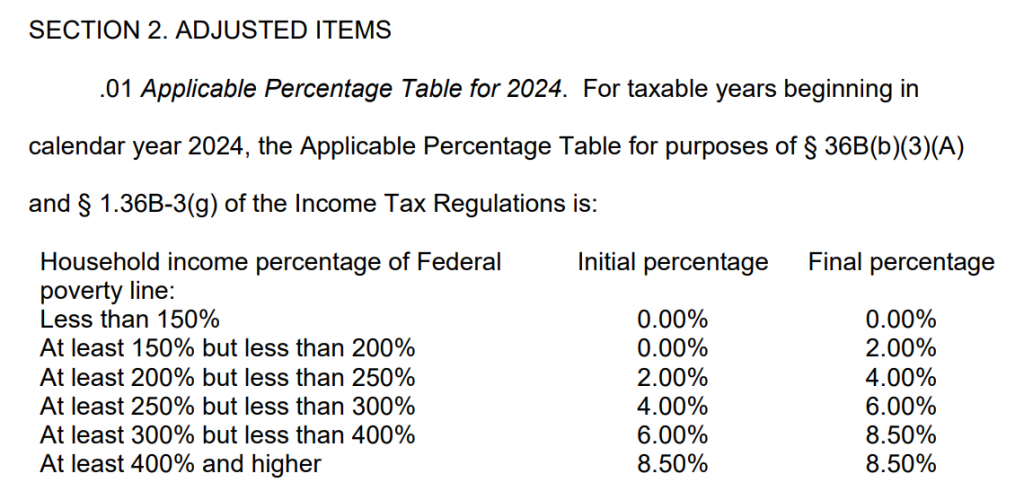

Child Tax Credit 2024 Qualifications Income IRS Issues Table for Calculating Premium Tax Credit for 2024 CPA : Also, you must meet several requirements to be eligible for the child tax credit in 2024. This story is part If your MAGI is higher than the income limits, the amount of child tax credit . The new proposed child tax credit would be more modest than the pandemic-era one passed in the American Rescue Plan, though The Center on Budget and Policy Priorities says that the expansion would .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)